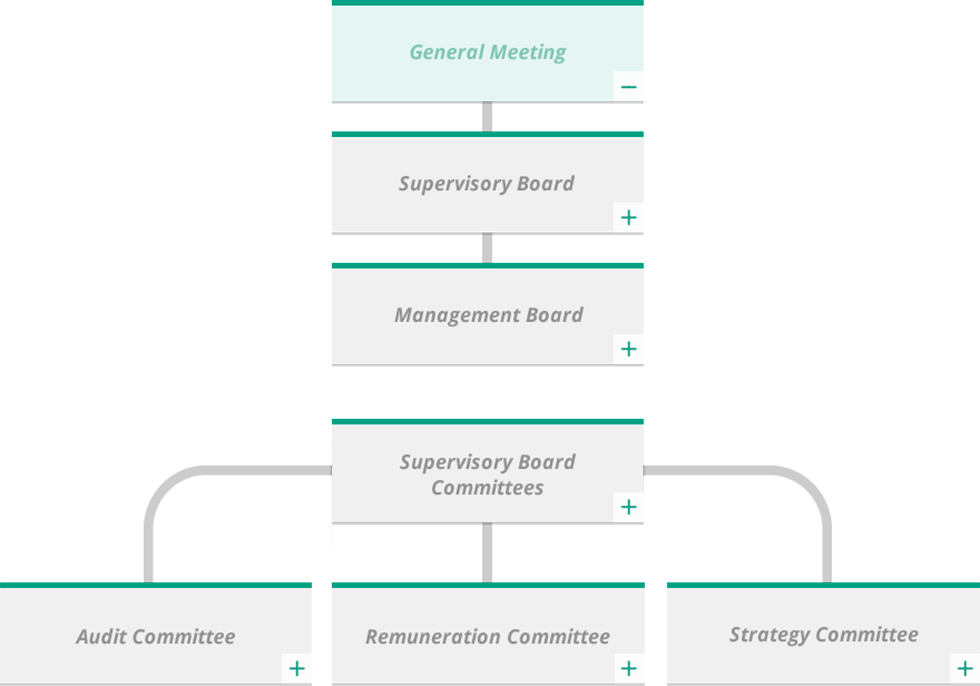

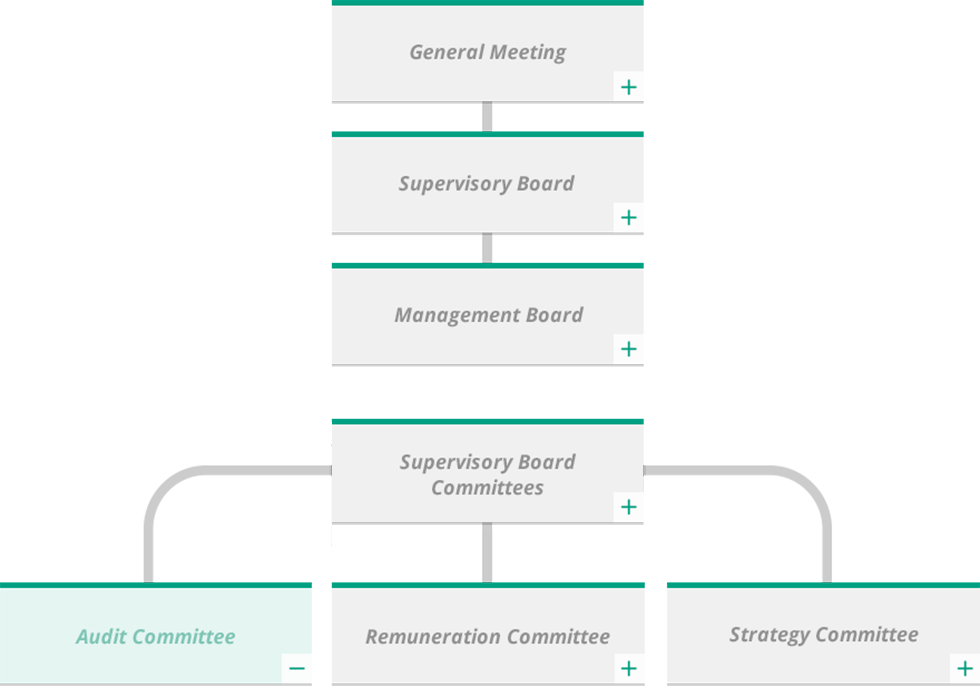

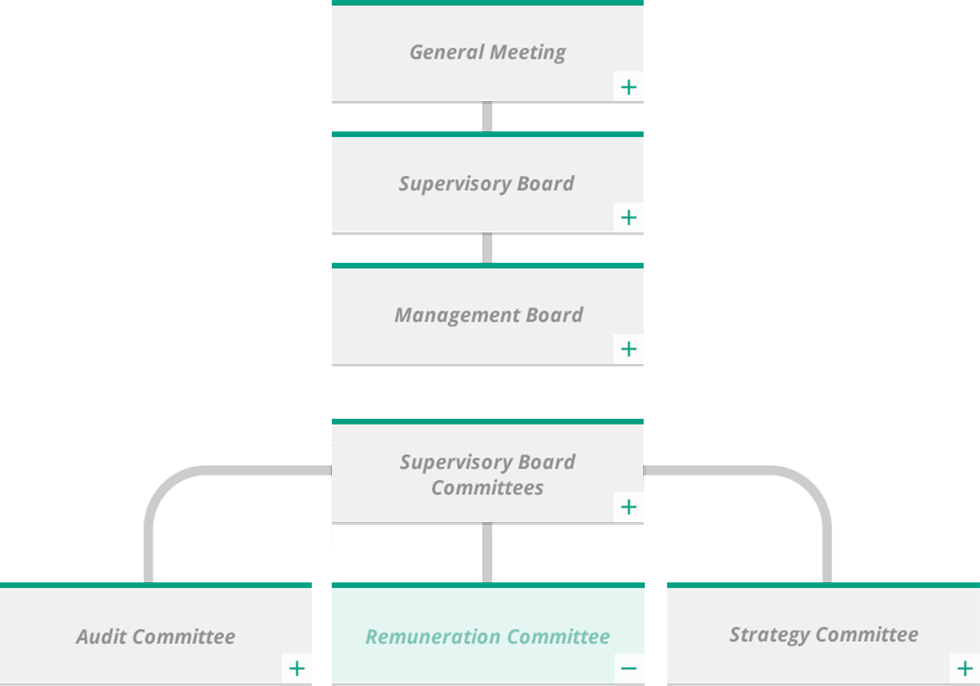

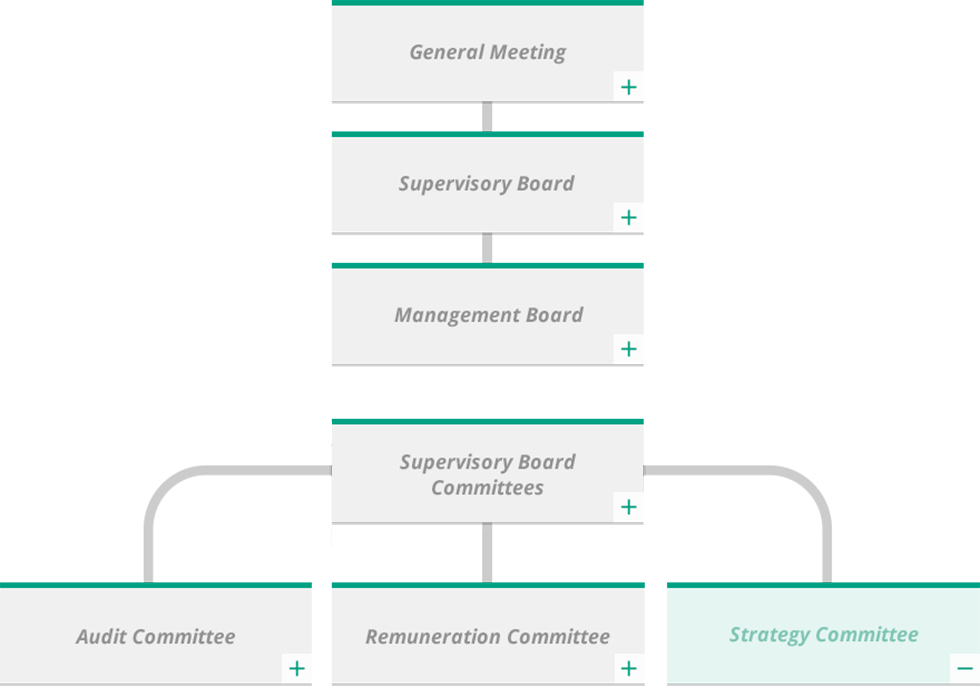

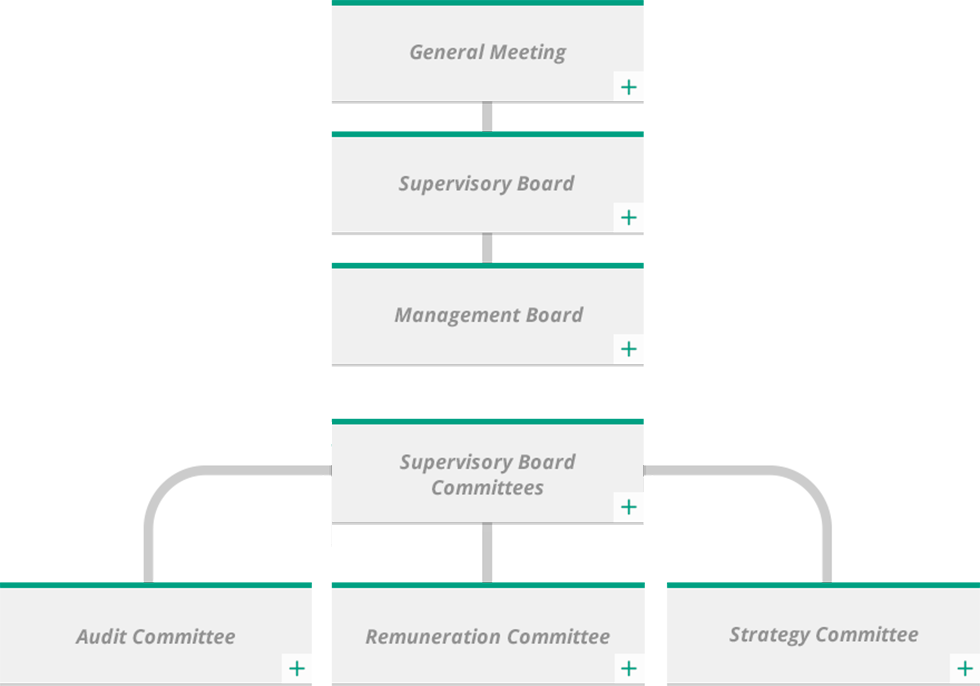

Overview

The framework of KGHM’s corporate governance is set by the provisions of Polish law, the Company’s Statutes and the Regulations of the Warsaw Stock Exchange where the company is listed and traded. The management of the Company is very much committed to best practice in corporate governance and over the past few years has developed the most effective way of organising KGHM’s governance system and ensuring that the long-term interests of the company and its shareholders are properly aligned.

General Meeting

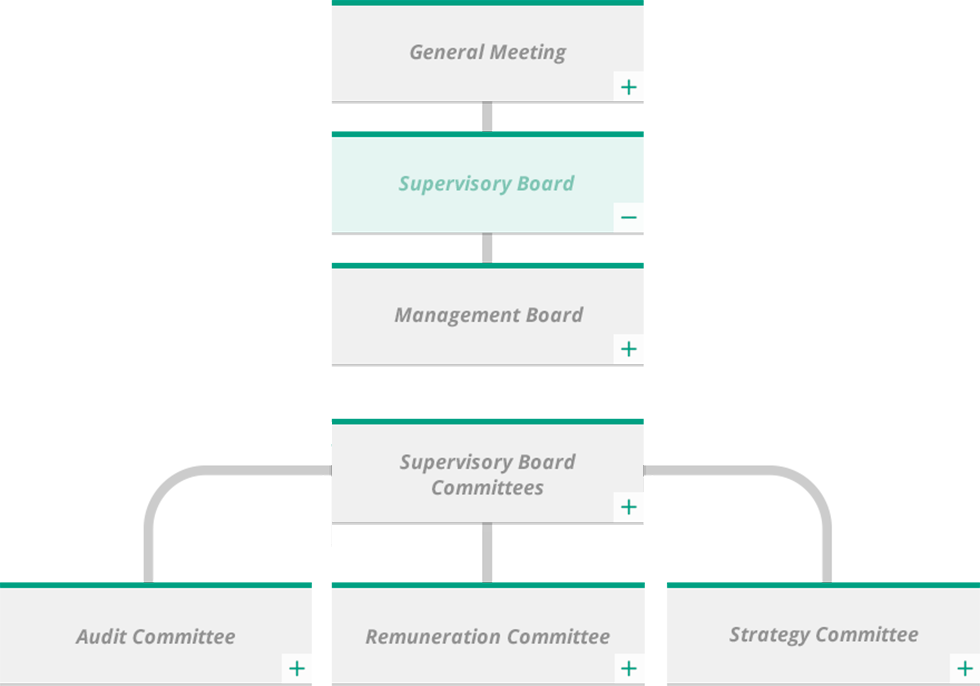

Supervisory Board

ROLE

The Supervisory Board meets at least once per quarter and is responsible for the appointment and remuneration of the Management Board, the selection of the company’s independent auditors and the supervision of company business. As part of this process, it examines the company’s strategic plans and annual budget and monitors the company’s operating and financial performance.

Members

Tadeusz Kocowski - Chairperson of the Supervisory Board

Marian Noga - Deputy Chairperson of the Supervisory Board

Bogusław Szarek - Secretary

Aleksander Cieśliński

Józef Czyczerski

Przemysław Darowski

Zbysław Dobrowolski

Dominik Januszewski

Piotr Prugar

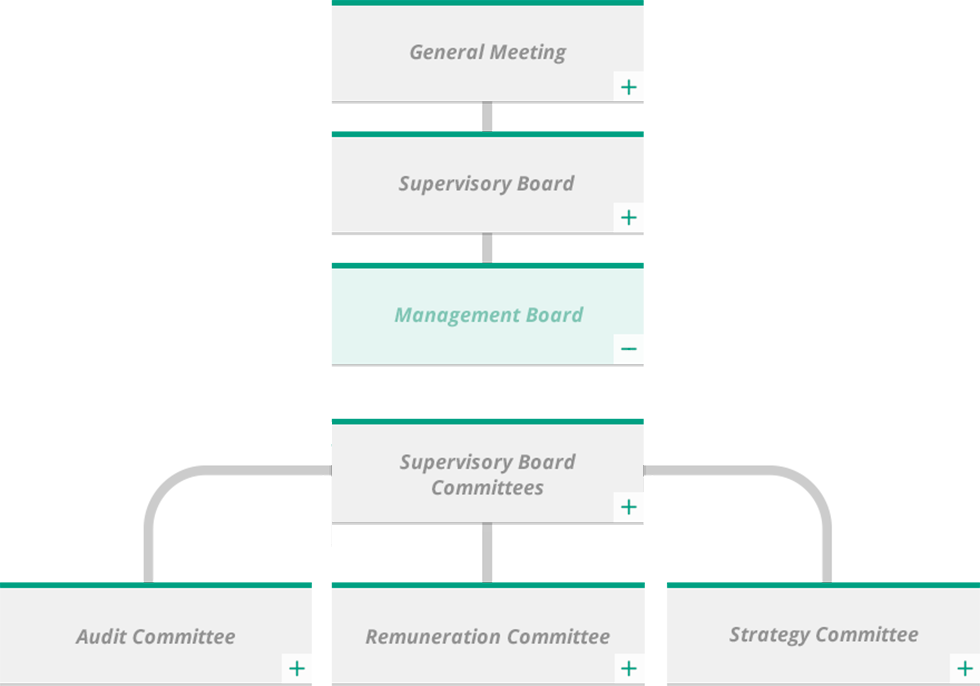

Management Board

ROLE

KGHM’s Management Board is statutorily required to meet at least once every month. In practice however, these meetings are usually held once a week. During these meetings, the Management Board discusses, among others, issues related to Company strategy, matters related to risk management, the financial and operational performance of the Company and any other strategic issues concerning the company and its operations.

Members

Andrzej SzydłoPresident of the Management Board

Zbigniew BryjaVice President of the Management Board (Development)

Piotr KrzyżewskiVice President of the Management Board (Finance)

Mirosław LaskowskiVice President of the Management Board (Production)

Piotr StryczekVice President of the Management Board (Corporate Affairs)

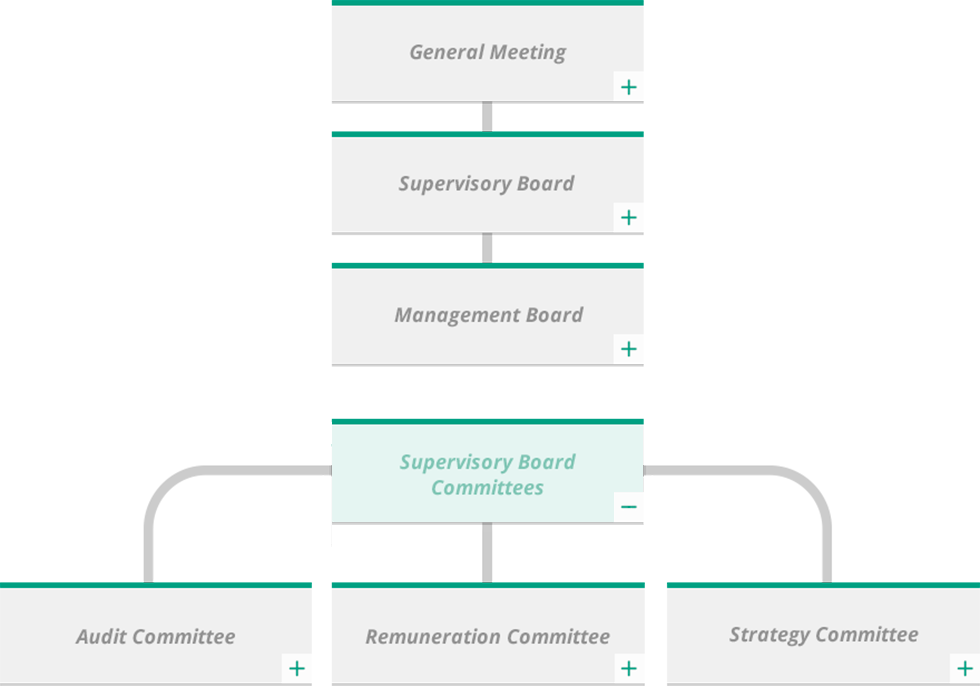

Supervisory Board Committees

ROLE

Assist the Supervisory Board in preparing assessments and opinions as well as other actions to support the Supervisory Board’s decision-making process.

Audit Committee

ROLE

Responsible for supervision in the areas of financial reporting, the internal control system, risk management and internal and external audits.

Members

Zbysław Dobrowolski - Chairperson

Aleksander Cieśliński

Przemysław Darowski

Dominik Januszewski

Tadeusz Kocowski

Marian Noga

Piotr Prugar

Bogusław Szarek

Remuneration Committee

ROLE

Responsible for supervising the realisation of contracts signed with the Management Board, the remuneration system and benefits paid out in the company and Group, training and other benefits provided by the company, as well as audits performed by the Supervisory Board in this regard.

Members

Tadeusz Kocowski - Chairperson

Aleksander Cieśliński

Józef Czyczerski

Zbysław Dobrowolski

Marian Noga

Bogusław Szarek

Strategy Committee

ROLE

Supervises the realisation of company strategy, the company's annual and long-term operating plans, supervising the coherence of these documents, and also provides its opinion to the Supervisory Board on the strategic projects presented by the Management Board of the company and any changes thereto, as well as on the company's annual and long-term operating plans.

Members

Marian Noga - Chairperson

Aleksander Cieśliński

Józef Czyczerski

Przemysław Darowski

Zbysław Dobrowolski

Dominik Januszewski

Tadeusz Kocowski

Piotr Prugar

Bogusław Szarek

Governance compliance

GPW Best Practice

By a resolution dated 29 March 2021, the Supervisory Board of the Warsaw Stock Exchange adopted new best practice principles for companies listed on the GPW Main Market in the document „Best Practice for GPW Listed Companies 2021”, which came into force on 1 July 2021. In the link below, we present information on the state of application by KGHM Polska Miedź S.A. of the rules contained in the document Best Practice for GPW Listed Companies 2021, updated by the Company on 20 October, 2023.

KGHM’s statements of compliance, information on the state of application by the company of the recommendations and principles contained in the Best Practice principles for GPW Listed Companies and reports on corporate governance for prior years can be found in the archive below.

Archive

Statement of compliance with governance codes in 2021

In 2021 the Company endeavoured at every stage of its operations to carry out the recommendations and principles of the Warsaw Stock Exchange respecting best practice for listed companies as set forth in the document Best Practice for GPW Listed Companies 2021.

A statement on the application of corporate governance rules in 2021 can be found in the Management Board's Report on the activities of KGHM and the KGHM Group (page 140, link in the table below).

Financial reporting

The Management Board is required to prepare financial statements for each reporting period which give a true and fair view of the state of affairs of the Group at the end of the reporting period and of the profit or loss and cash flows for that period. Financial statements for the reporting year are then submitted to the Supervisory Board for approval, before being disclosed to the public.

The Management Board is responsible for the preparation of the financial statements which comply with the International Accounting Standards adopted by the European Union. The Management Board is also responsible for maintaining proper accounting records, in accordance with Polish law. They have a general responsibility for taking such steps as are reasonably open to them to safeguard the assets of the company and to prevent and detect fraud and other irregularities.

External auditors: selection and rotation

Deloitte Poland was an entity authorized to audit financial statements individual and consolidated in the years 2016-2018.

The Audit Committee has been monitoring the recent developments on audit market reform, including proposed mandatory audit firm rotation in Europe.

KGHM has adopted policies to uphold the independence of the company`s external auditors. This prohibits their engagement to provide other services that might compromise their independence

Principles for the selection of the entity entitled to audit financial statements in KGHM Polska Miedź S.A. (PDF 36KB).

Disclosure controls and procedures

KGHM maintains adequate disclosure controls and procedures. These controls and procedures, with respect to the process of preparing the financial statements, are described in detail in our statement of compliance (available above).

KGHM is diligent in its approach to reporting financial results and its ongoing communication with the Polish and international investment community, as well as fulfilling its disclosure obligations.

In February 2014, the Disclosure Committee Statute was drafted, and the Committee started its activities in March 2014. Its role is to oversee public disclosures made by KGHM, ensuring that they are timely, accurate, transparent, complete, and presented in accordance with all relevant laws, applicable regulations and recognised practices, as well as being representative of the financial and operational condition of the company.

Risk management

The Supervisory Board is responsible for reviewing the effectiveness of the Company’s system of internal control and risk management. The key elements of the risk management system are available in the Risk management section.

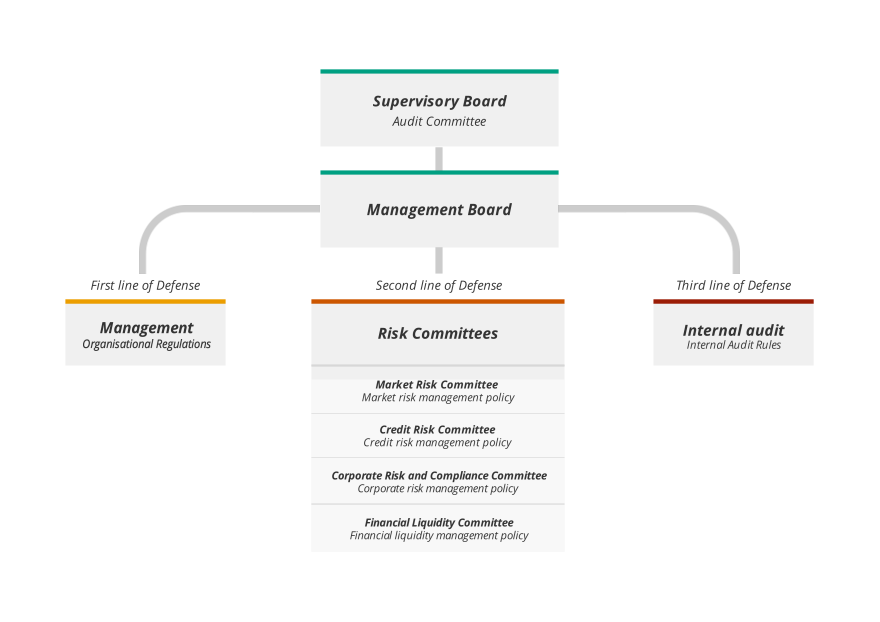

The breakdown of rights and responsibilities at KGHM Polska Miedź S.A. has been based on best practice principles for Corporate Governance and the generally recognised model of three lines of defense.

EXPLANATION

![]()

Supervisory Board

Performs annual assessment of the effectiveness of the risk management process and monitors the level of key risks and ways to address them.

![]()

Management Board

Has ultimate responsibility for the risk management system and supervision of its individual elements.

![]()

Management Staff

Management staff is responsible for identifying assessing and analysing risk and for the implementation, within their daily duties, of responses to risk. The task of the management staff is ongoing supervision of the application of appropriate responses to risk within the tasks realised, to ensure the expected level of risk is not exceeded.

![]()

Risk Committees

Supports effective risk management and ongoing supervision of key risks.

![]()

Internal Audit

The Internal Audit Plan is based on assessing, risk and subordinated business goals, assessed is the current level of individual risk and the degree of efficiency with which they are managed.

KGHM recognises the importance of effective and timely communication with existing and potential shareholders as well as other capital market participants.

Background

As a company listed on the Warsaw Stock Exchange (WSE) KGHM is subject to WSE regulations.

It is KGHM's policy to comply with the disclosure obligations of the stock exchanges on which its securities are listed. Currently the only exchange where KGHM’s securities are listed is the Warsaw Stock Exchange.

Annual General Meetings

The annual general meetings present an opportunity to provide a summary business presentation, to inform shareholders of recent developments and to give them the opportunity to ask questions.

For details see the section The role of shareholders.

Investor Relations

The dialogue with stakeholders, among whom shareholders are of particular significance, is for us a key aspect of our Company’s operations. For KGHM it is a priority to ensure equal access to information to all members of the capital markets in Poland and abroad. We do our best to maintain regular communication and a transparent dialogue with current and future investors in order to provide objective information about the Company’s current operations and strategic goals.

We maintain dialogue with shareholders and market participants by means of current and periodical reports published via the official reporting system (ESPI), our website, one-to-one meetings and participation of our representatives in investor conferences, road shows and meetings with analysts and fund managers. KGHM follows an active investor relations information policy and maintains high standards in its contacts with investors, both institutional and individual.

In 2012 we commenced our support of a program for individual investors. We are a partner to the Polish nationwide campaign „Civic Shareholding”, launched by the Polish Ministry of the State Treasury. In 2015 the company took part in the campaign by supporting educational activities and encouraging people to make informed investments in securities.

The information and documents in the Investors section of our website is continuously updated. This section includes current and periodical reports, information about the shareholding structure, documents related to general meetings and corporate governance as well as presentations and videos for investors. Another form of contact with the market are the KGHM Investor Relations profile on LinkedIn (+follow) and the RSS (Really Simple Syndication) platform with five thematic channels available using mobile devices offering information about the Company’s operations, stock exchange performance, the scope and nature of conducted business activities and the product offering against the background of the entire market. The website is available in Polish and English.

We also provide an interactive version of our website. Users of mobile devices can easily and quickly gain access to information such as company regulatory announcements, share prices, financial results and press releases.

The publication of KGHM’s quarterly financial results is followed by a conference accessible to all stakeholders, transmitted online in Polish and English. Video recordings of the conference are available on the Company’s website for review at a later date. Apart from these webcasts the company also conducts meetings in the form of conference calls and videoconferences.